Buying a home is a significant investment and one of the most important decisions a person can make. It can be overwhelming and daunting, especially for first-time homebuyers. However, with proper research, planning, and guidance, the process can be a rewarding and enjoyable experience. This blog will provide you with essential information and tips on buying a home. From understanding the housing market to determining your budget, we will cover all the critical factors you need to consider before purchasing. We will also guide you through finding the perfect home, negotiating the price, and securing financing. Furthermore, we will discuss the importance of home inspections and how to avoid common mistakes that can lead to costly repairs. We aim to provide you with all the necessary knowledge and resources to make informed decisions and ensure a smooth home-buying process.

1. Determine your budget and goals.

One of the most important steps in the home-buying process is determining your budget and goals. This will help you focus your search and avoid the disappointment of falling in love with a home that is beyond your financial means. Start by assessing your current financial situation, including your income, expenses, debts, and credit score. This will give you a clear idea of how much you can spend on a home. Once you have a budget in mind, consider your goals for buying a home. Are you looking for a long-term investment or a starter home? Do you need a certain number of bedrooms or a certain location? Knowing your goals will help you narrow your search and make more informed decisions when viewing potential homes. It’s important to remember your budget and goals throughout the home-buying process to ensure you find a home that meets your needs and fits within your financial means.

2. Research potential neighborhoods and local amenities.

One of the most important steps when buying a home is researching potential neighborhoods and local amenities. This involves more than just finding a house that fits your budget and taste; you must also consider the surrounding area and what it offers. Start by identifying your priorities: are you looking for a quiet suburban neighborhood with good schools or a bustling urban area with lots of nightlife and cultural attractions? Once you have a general idea of what you’re looking for, start researching specific neighborhoods that fit the bill. Look at crime rates, school ratings, public transportation options, and other factors impacting your quality of life. Don’t forget to consider local amenities, like parks, shopping centers, and restaurants. All these factors will affect your overall satisfaction with your home-buying experience, so take the time to research before deciding.

3. Hire a reputable real estate agent.

When buying a home, hiring a reputable real estate agent is crucial. These professionals have the experience, knowledge, and resources to help you find the right property, negotiate a fair price, and guide you through the complex home-buying process. A good agent can also help you avoid costly mistakes and ensure that you’re making a sound investment. When looking for an agent, it’s important to research and choose someone with a proven track record of success in the market you’re interested in. Don’t be afraid to ask for references and check online reviews to understand their reputation. Remember, a good agent is there to represent your interests and help you achieve your home-buying goals.

4. Attend open houses and viewings.

Attending open houses and viewings is an essential part of the home-buying process. These events allow buyers to explore and evaluate various properties on the market. By attending open houses and viewings, potential home buyers can better understand what kind of home they want, what features and amenities they need, and what their budget can realistically afford. This is also a chance to ask questions and better understand the home’s history, age, and condition. Home buyers must attend multiple open houses and viewings to understand the market better and compare and contrast different properties. By doing so, home buyers can make informed decisions about the home they want to purchase and ultimately make the best investment for their future.

5. Get pre-approved for a mortgage.

Getting pre-approved for a mortgage is a crucial step in the home-buying process. It involves submitting your financial information to a lender, who will assess your creditworthiness and determine how much they will lend you for a home purchase. Having a pre-approval letter in hand when you begin your home search can give you a competitive advantage over other home buyers, as it shows sellers that you are a serious and capable buyer. Additionally, it can help you avoid the disappointment of falling in love with a home that is out of your budget. When you are ready to start the home-buying process, prioritize getting pre-approved for a mortgage.

6. Review the seller’s disclosure statement.

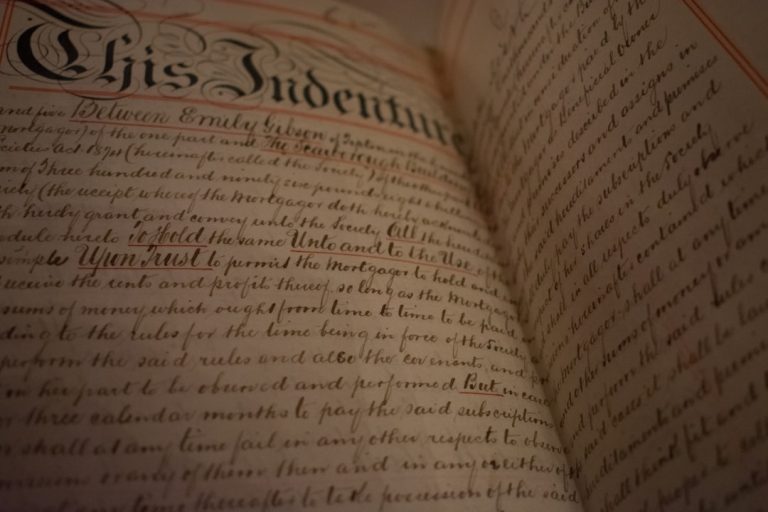

One of the crucial steps in the home-buying process is reviewing the seller’s disclosure statement. This document provides valuable information about the property you are considering buying. The seller is legally required to disclose any known defects, damages, or issues with the home that could affect the property’s value or your decision to buy it. The disclosure statement may include details about the property’s history, such as past repairs, renovations, or upgrades. It may also provide information about the condition of major systems, such as the HVAC, plumbing, and electrical systems. As a home buyer, it is important to carefully review the disclosure statement and ask questions if you have any concerns or questions. By doing so, you can make an informed decision about buying a home that meets your needs and fits your budget.

7. Hire a home inspector.

When buying a home, it’s important to hire a home inspector. A home inspector will thoroughly examine the property to identify potential issues that may not be visible to the untrained eye. By doing so, you can avoid any surprises and protect yourself from unforeseen expenses down the road. Home inspectors will examine the home’s structural integrity, electrical systems, plumbing, heating and cooling systems, and any potential safety hazards. They will also check for signs of water damage, infestations, and other issues affecting the home’s value and livability. Home buyers should always insist on getting an inspection report before finalizing the deal. This report will provide a detailed overview of the home’s condition and any necessary repairs that need to be made before moving in. Hiring a home inspector is a small price for peace of mind and a smooth home-buying process.

8. Close the deal with confidence.

Buying a home can be a daunting task. You may have found the perfect property and negotiated a great price, but closing the deal can still seem overwhelming. However, with the right preparation, you can confidently approach the sale. First, make sure you have reviewed all the documents and contracts thoroughly. Ask any questions, and don’t be afraid to seek advice from a real estate lawyer. Ensure you have secured financing and all the necessary funds available for closing costs.

In conclusion, home buying is a significant investment that requires careful consideration and planning. Understanding the process, including the financial aspects, is essential before making any decisions. Researching and consulting with experts can help you make informed and sound decisions as you navigate the home-buying process. Remember, with proper preparation and guidance, owning a home is a rewarding experience that can provide long-term financial stability and a place to call your own.