Lending money is a common practice in the financial world, where individuals or institutions lend to borrowers in exchange for interest or other charges. As a lender, it is essential to understand the risks and rewards of lending money and make informed decisions based on the borrower’s creditworthiness and ability to repay the loan. Whether you are lending money to a friend, family member, or a business, it is crucial to have a clear agreement to avoid potential misunderstandings or disputes.

This blog post will explore the different aspects of lending money, including the types of loans available, the factors to consider before lending money, and the steps involved in the lending process. We will also cover the legal and regulatory requirements that lenders must comply with and provide tips on mitigating common risks associated with lending money.

Lending money can be a rewarding experience, as it helps businesses and individuals achieve their financial goals. However, it also comes with its fair share of challenges and risks.

1. Understand the borrower’s needs.

When lending money, it’s important to understand the borrower’s needs. This means listening to their goals, financial situation, and reasons for seeking a loan. You can better tailor the loan to meet their specific requirements by understanding their needs. For example, a payday loan might be the best option if they need the money for a short-term emergency. However, a personal loan with a longer repayment term might be more appropriate if they want to make a large purchase. Ultimately, lending money should be about helping the borrower achieve their goals while minimizing risk for both parties. By taking the time to understand their needs, you can create a loan that’s a win-win for everyone involved.

2. Determine your lending criteria.

Before you start lending money, it is crucial to determine your lending criteria. This means you need to decide what type of loan you will be offering, how much money you are willing to lend, and what the repayment terms will be. You should also consider the creditworthiness of the borrower, their income level, and how long they have been in business if they are seeking a business loan. It is important to remember that lending money comes with inherent risks, and you need to be comfortable with your risk level. By setting clear lending criteria, you can reduce the risk of loan defaults and ensure you are lending money responsibly and sustainably.

3. Assess the borrower’s creditworthiness.

Assessing the borrower’s creditworthiness is a crucial step in the lending process. Before lending money, the lender needs to ensure the borrower can repay the loan. To do this, the lender must analyze the borrower’s credit score and credit history. A credit score is a number that represents the borrower’s creditworthiness and is calculated based on their credit history, payment history, and other factors. The lender should also look at the borrower’s debt-to-income ratio, the amount of debt they have compared to their income. A high debt-to-income ratio could indicate that the borrower may struggle to repay the loan. Additionally, past bankruptcies, foreclosures, and delinquencies can be red flags that the borrower may not be a reliable candidate for a loan. By carefully assessing the borrower’s creditworthiness, the lender can decide whether to approve or deny the loan.

4. Establish a repayment plan.

When you lend money to someone, it’s important to establish a repayment plan. This will help ensure you get your money back promptly and prevent misunderstandings or disagreements about the loan terms. When creating a repayment plan, consider factors such as the amount of the loan, the interest rate, and the borrower’s ability to repay. You may want to set up a schedule of regular payments, such as weekly or monthly, or you may agree on a lump sum payment on a specific date. Be sure to document the loan terms and the repayment plan in writing, and have both parties sign the agreement. This will provide a legal record of the loan and help protect both the lender and the borrower in case of any disputes.

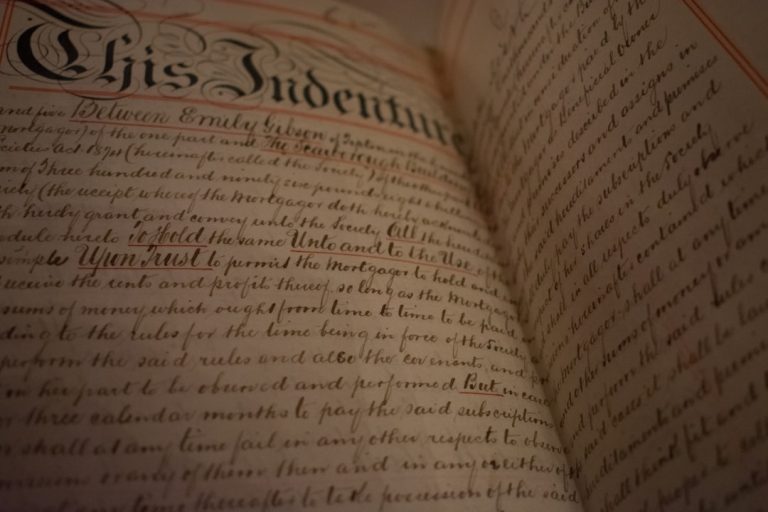

5. Draft a legally binding agreement.

When lending money to someone, it’s important to have a legally binding agreement to protect both parties involved. This agreement should clearly outline the loan terms, including the amount borrowed, the interest rate, the repayment schedule, and any collateral being used to secure the loan. The agreement should also detail what will happen in the event of a default or late payment. By having a written agreement, both parties are protected and clearly understand their responsibilities and obligations. It’s highly recommended to consult a lawyer to draft the contract to ensure it complies with all applicable laws and regulations. Lending money is serious, and a well-drafted agreement can help prevent potential disputes and legal issues.

6. Set clear boundaries and expectations.

Setting clear boundaries and expectations is essential when it comes to lending money. Before lending anyone money, it’s important to set the ground rules and ensure that both parties understand the loan terms. You should determine the amount of the loan, the repayment schedule, and any interest rates that will be applied over the repayment period. Furthermore, you should set clear expectations of how the borrower will use the loaned money and what actions you will take if the borrower fails to repay the loan. By setting clear boundaries and expectations, you can avoid misunderstandings and ensure that both parties are on the same page throughout the lending process. This can also help protect your financial interests and prevent potential disagreements or legal issues arising from a lack of clarity in the lending process.

7. Monitor the borrower’s progress.

It is important to monitor the borrower’s progress regularly when lending money. This involves keeping in touch with the borrower and keeping track of the loan repayments. By doing so, you can ensure that the borrower makes timely payments and is on the way to repay the loan in full. Monitoring the borrower’s progress also helps you identify potential problems early on, such as missed payments or financial difficulties. In such cases, you can take appropriate action to help the borrower and protect your investment. Regular communication with the borrower also helps build trust and a good working relationship, which can be beneficial in the long run. Monitoring the borrower’s progress is crucial to lending money and should be done consistently and diligently.

8. Prepare for worst-case scenarios.

When lending money, it’s important to prepare for worst-case scenarios. No matter how trustworthy or responsible the borrower may seem, unexpected events can occur that may prevent them from being able to repay the loan. Planning what you will do if the borrower defaults on the loan is crucial as a lender. This may involve taking legal action, working with collection agencies, or even repossessing collateral if it was put up for the loan. It’s also important to have documentation and written agreements that outline the loan terms and what will happen in the event of default. This can help protect the lender and the borrower and ensure everyone is clear on their responsibilities and obligations. Preparing for worst-case scenarios can help minimize the risks of lending money and provide a more positive outcome for all involved.

To sum up, lending money can be a smart financial move for both the lender and borrower, but it’s important to approach it carefully. Before lending money, have a written agreement, set realistic expectations and repayment terms, and understand the potential risks involved. By following these guidelines and using common sense, lending money can be a beneficial way to help someone in need or earn extra income while maintaining financial security.