In today’s economy, borrowing money has become essential to personal finance. Whether for purchasing a house, paying off debts, or investing in a business, borrowing money can provide the necessary funds to achieve financial goals. However, it’s important to understand the risks of lending money and make informed decisions. Too much debt can lead to financial difficulties and impact credit scores, making it more challenging to secure future loans. Understanding the different types of borrowing available and their associated costs and risks is essential. By understanding the details of borrowing and how to manage it effectively, individuals can make the most of their financial resources. This blog post will explore the various aspects of borrowing money, from choosing the right loan option to managing repayments. It will provide insights into assessing the risks involved in borrowing and making informed decisions to achieve long-term financial goals. This blog post lets readers enhance their knowledge and make better money-borrowing decisions.

1. Understand Your Financial Situation

Before borrowing money, it’s essential to understand your financial situation. This means looking hard at your income, expenses, debts, and credit score. Knowing your current financial status can help determine if borrowing money is smart and how much you can afford. Start by creating a budget that lists all your income and expenses, including any outstanding debts you have. This will give you a clear picture of where your money is going and how much extra money you have each month that can be used for borrowing.

2. Determine Your Repayment Capacity

One of the most important steps when borrowing money is to determine your repayment capacity. This refers to your ability to repay the borrowed amount and any interest and fees within the agreed-upon repayment period. Before you borrow money, it’s crucial to assess your financial situation and create a budget that considers your income and expenses. This will help you determine how much money you can realistically borrow and repay without putting yourself in a difficult financial situation. It’s important, to be honest with yourself and not borrow more than you can comfortably pay back, as this can lead to missed payments, late fees, and damage to your credit score. By taking the time to determine your repayment capacity, you’ll be able to make informed borrowing decisions that will help you achieve your financial goals without putting yourself at risk.

3. Research Different Loan Options

When you need to borrow money, it’s important to research different loan options to find one that suits your needs. Not all loans are created equal, and choosing the wrong one could cost you more in the long run. Start by considering your needs and financial situation. Do you need a small loan that you can repay quickly, or do you need a larger loan that you can repay over time? Once you’ve determined how much you need to borrow, look at different types of loans, such as personal, installment, and credit cards. Each option has pros and cons, including interest rates, fees, and repayment terms. Compare different lenders and their offers to find the best option. With the right research and understanding of your borrowing needs, you can make an informed decision about borrowing money.

4. Compare Interest Rates and Fees

When borrowing money, comparing interest rates and fees from different lenders is important. Interest rates are the percentage that lenders charge for lending their money. A lower interest rate means you’ll pay less for the money you borrow over time. Lenders also charge fees for lending money, such as application fees, origination fees, and late payment fees. These fees can vary widely between lenders and add up quickly, so it’s important to consider them when comparing loan options. By comparing interest rates and fees, you can find the most affordable loan and save money over the life of the loan.

5. Check Lender Reviews and Ratings

When borrowing money, it’s important to do your research and find a lender that is reputable and trustworthy. One way to do this is by checking lender reviews and ratings. Several websites and review platforms allow borrowers to leave feedback and ratings for lenders they have worked with in the past. This can give you an idea of the lender’s level of customer service, the ease of the borrowing process, and any potential issues that may arise. Pay attention to positive and negative reviews, which can provide valuable insights into the lender’s practices. By doing your due diligence and checking lender reviews and ratings, you can make a more informed decision when choosing a lender to borrow money from.

6. Read and Understand the Terms

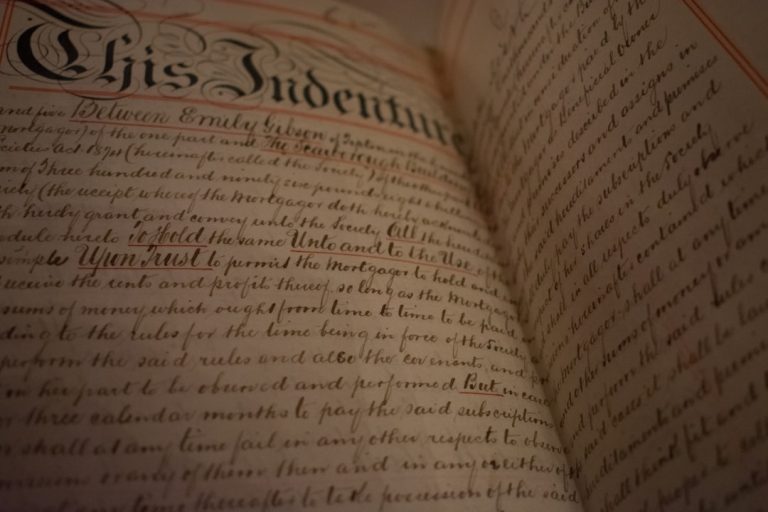

When borrowing money, it is essential to read and understand the terms of the loan agreement. This will ensure that you know the cost of borrowing and the repayment obligations. Before signing any loan agreement, take the time to review all the terms and conditions, including the interest rate, fees, and repayment schedule. Ensure you understand the penalties for late payments and any other consequences of defaulting on the loan. It is also important to understand the effects of early repayment, as some lenders may charge a penalty for paying off the loan early. Overall, taking the time to read and understand the terms of a loan before borrowing can help you avoid any unpleasant surprises down the road.

7. Analyze the Risks and Benefits

When considering borrowing money, it’s essential to analyze the risks and benefits of the decision. Borrowing money can be a helpful tool in achieving financial goals, such as purchasing a home or car, but it comes with its own set of potential risks. The most significant risk of borrowing money is the possibility of defaulting on the loan, which can lead to damaged credit scores and legal action by the lender. Furthermore, borrowing money can often lead to high-interest rates and additional fees, increasing the overall cost. However, borrowing money can also have benefits, such as improving credit scores and providing access to funds for necessary purchases. Before deciding to borrow money, it’s crucial to carefully weigh the potential risks and benefits and only borrow what you can afford to repay.

8. Make an Informed Decision.

When borrowing money, it’s important to make an informed decision. This means researching and understanding the terms and conditions of any loan or line of credit you may be considering. Before you borrow, look at your current financial situation and assess whether or not you truly need to borrow money. If you do, look at different lenders, interest rates, and repayment terms to determine which option is best for you. Be sure to read the fine print and understand any fees or penalties associated with borrowing. Making an informed decision can save you money and prevent you from debt or financial hardship.

In conclusion, borrowing money can be a helpful solution in certain situations, but it is important to approach it with caution and responsibility. Consider your options, weigh the pros and cons, and ensure you fully understand the terms and conditions before accepting any loan. Remember to borrow only what you need and can afford to pay back, and always make your payments on time to avoid damaging your credit score. By following these guidelines, you can make informed decisions about borrowing money and use it to achieve your financial goals.

1 thought on “Borrowing Money”